The global electric vehicle battery market is no longer in its experimental phase. By 2025, it has clearly entered an era of scale, dominance, and strategic consolidation. The latest data from SNE Research tells a story that industry insiders have sensed for some time but can now confirm with hard numbers: the center of gravity in EV batteries has firmly shifted toward a small group of highly capable players, led decisively by China.

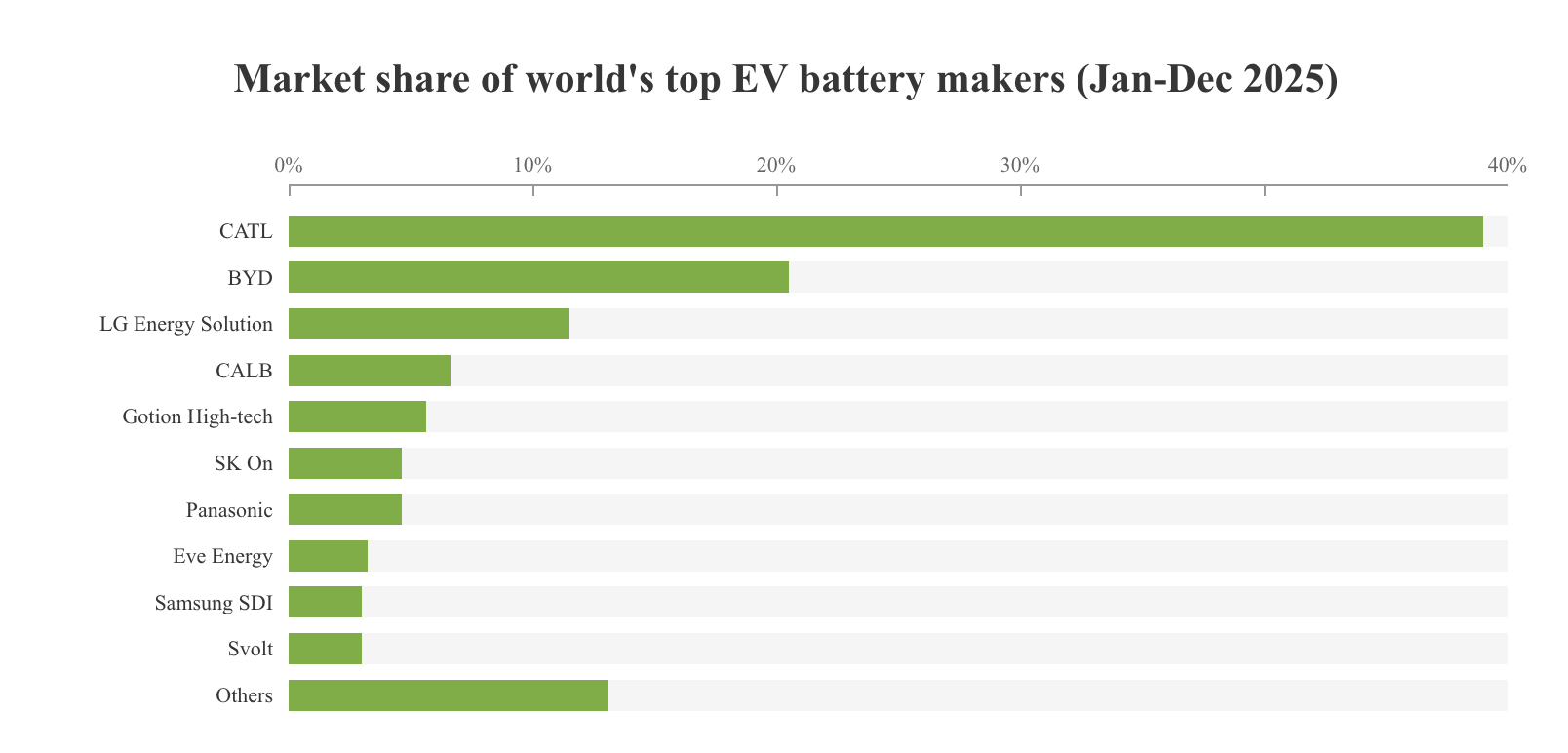

Global EV battery installations reached 1,187 GWh in 2025, a staggering 31.7 percent year-on-year growth. That growth, however, is not evenly distributed. Two companies alone, CATL and BYD, account for 55.6 percent of all EV batteries installed worldwide. In a sector that underpins the future of mobility, this level of concentration is remarkable and consequential.

This is not just a story about numbers. It is a story about industrial strategy, execution at scale, and the quiet reshaping of global automotive power.

The Big Picture: Explosive Growth, Uneven Gains

The jump from 901.4 GWh in 2024 to 1,187 GWh in 2025 reflects more than rising EV sales. It signals improved supply chain resilience, faster factory ramp-ups, and maturing battery chemistries that manufacturers are now confident deploying at mass scale.

Yet while the market expanded rapidly, the benefits flowed disproportionately to the leaders. Smaller players grew, but not fast enough to challenge the front-runners. In effect, 2025 became the year when leadership turned into dominance.

CATL

CATL’s performance in 2025 deserves to be described in superlatives, but the numbers alone already do most of the talking.

With 464.7 GWh of EV battery installations, CATL captured 39.2 percent of the global market, up from 38.0 percent in 2024. In absolute terms, that represents a 35.7 percent increase over the previous year. More importantly, CATL remains the only battery maker in the world with a market share above 30 percent.

From an industry perspective, this is extraordinary. Battery supply is capital-intensive, technologically complex, and deeply integrated with automaker platforms. Maintaining leadership at this scale suggests that CATL is not merely riding demand but actively shaping it.

CATL’s advantage lies in its breadth. It supplies across vehicle segments, chemistries, and geographies. Automakers value its reliability, production consistency, and ability to scale quickly when new models succeed. In 2025, CATL did not just defend its position, it widened the gap.

BYD

BYD remains the world’s second-largest EV battery supplier, and its 194.8 GWh of installations in 2025 underline just how formidable the company still is. That figure represents a 27.7 percent year-on-year increase, a growth rate most competitors would envy.

However, BYD’s market share slipped slightly to 16.4 percent, down from 16.9 percent in 2024. This decline does not signal weakness so much as the brutal arithmetic of competing against CATL’s faster expansion.

BYD’s battery story is also different in nature. Unlike CATL, BYD consumes a significant portion of its own batteries for its vehicles. This vertical integration provides stability and cost control but can limit external market share growth compared to a pure-play supplier.

In 2025, BYD remained firmly in second place, but the data shows a clear reality: closing the gap with CATL is becoming increasingly difficult.

Together, CATL and BYD installed 659.5 GWh of batteries in 2025, accounting for more than half of global demand. In most industrial sectors, such a concentration would raise eyebrows. In EV batteries, it raises strategic questions for automakers, governments, and competitors alike.

This combined dominance gives the two companies enormous influence over pricing trends, technology adoption, and supply stability. For automakers outside China, reliance on these suppliers is increasingly unavoidable.

LG Energy Solution

In third place, LG Energy Solution recorded 108.8 GWh of installations in 2025, marking an 11.3 percent increase year on year. While growth continued, LG’s market share fell to 9.2 percent, down from 10.9 percent in 2024.

This decline highlights the challenge facing non-Chinese suppliers. LG remains deeply embedded with major global automakers, particularly in North America and Europe, but the pace of expansion has not matched that of its Chinese rivals.

LG’s position is still strong, but 2025 made it clear that maintaining relevance now requires not just innovation, but faster and more aggressive scaling.

The Middle Tier: Solid Players

Below the top three, the market becomes more fragmented.

CALB ranked fourth with 62.8 GWh and a 5.3 percent share, followed by Gotion High-tech at 4.5 percent. These companies are growing steadily and benefiting from China’s massive domestic EV ecosystem, but they remain well behind the leaders.

SK On and Panasonic each held 3.7 percent, while Eve Energy, Samsung SDI, and Svolt Energy rounded out the top ten with market shares ranging between 2.4 and 2.6 percent.

Notably, the combined “Others” category still accounted for 10.5 percent or 124.9 GWh, showing that niche suppliers and regional players continue to exist, though their collective influence is shrinking.

Technology and Execution: Why Leaders Stay Ahead

What separates the leaders from the rest in 2025 is not a single breakthrough but execution across multiple fronts. High-volume manufacturing, cost discipline, diversified chemistries, and close collaboration with automakers have become more important than headline-grabbing innovations.

CATL and BYD have mastered this balance. They scale quickly, adapt chemistry choices to market needs, and deliver consistently. For automakers under pressure to reduce costs and avoid supply disruptions, reliability matters as much as energy density or charging speed.

Conclusion

The 2025 data confirms a shift that is likely to define the next decade of electric mobility. The EV battery market is no longer wide open. It is consolidating around a small group of players with the capital, technology, and industrial depth to serve a global industry.

For challengers, the path forward is narrowing. For automakers, supplier strategy is becoming a critical part of competitiveness. And for policymakers, the concentration of battery supply raises questions about energy security and industrial independence.

One thing is certain: in 2025, the global EV battery market did not just grow, it chose its leaders. CATL leads, BYD follows, and the rest are now racing to keep up.

For more auto and tech related news visit Autoncell

-original.webp)

-original.webp)

-original.webp)

-original.webp)